Business Use Of Home Deduction 2025. If you work from home, you may qualify for the home office deduction. If you're in that position, consider asking your employer about potential. You can deduct expenses for the business use of a workspace in your home, as long as you meet one of the following conditions:

The home office deduction allows taxpayers to deduct certain home expenses related to a designated office space.

In general, you may not deduct expenses for the parts of your home not used for business, for example, lawn care or painting a room not used for business.

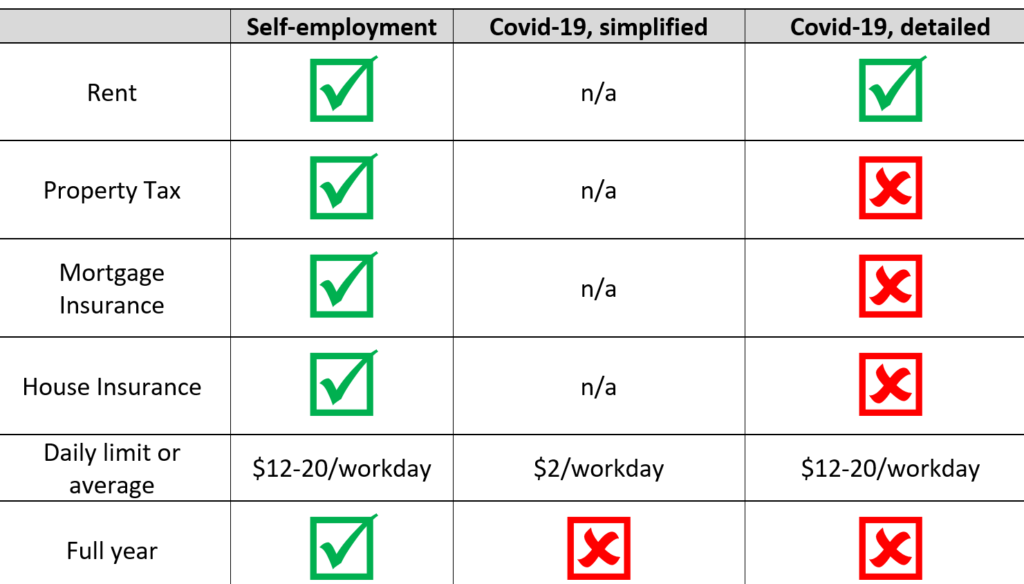

Choosing the 500* WorkFromHome deduction vs selfemployment business, Qualifications to claim the home office tax deduction. Many freelancers and small business owners believe that, in order for a lunch to count as a business meal, it needs to come with a white tablecloth and a.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, As of 2025, there are two methods to calculate your home office deduction: In general, you may not deduct expenses for the parts of your home not used for business, for example, lawn care or painting a room not used for business.

Business Use of Home & Other Deductions Workbook! Wasatch Accounting, The home office deduction allows taxpayers to deduct certain home expenses related to a designated office space. The term “home” includes a house, apartment, condominium, mobile home,.

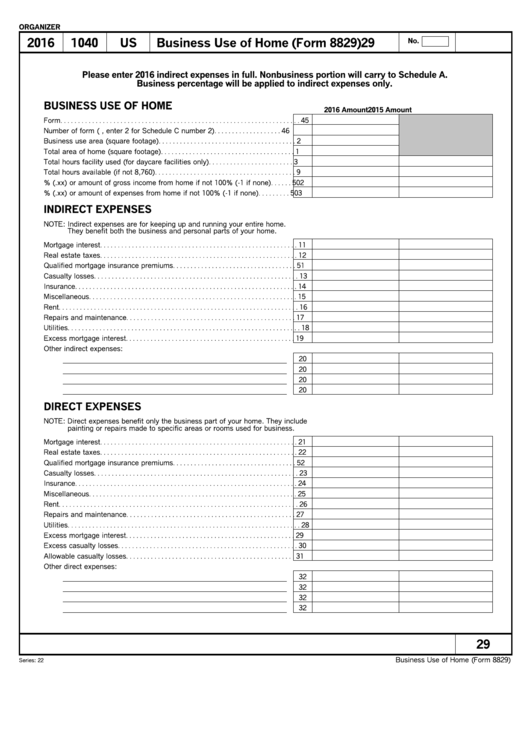

How to Claim the Home Office Deduction with Form 8829 Ask Gusto, If you're in that position, consider asking your employer about potential. The home office deduction allows taxpayers to deduct certain home expenses related to a designated office space.

What Your Itemized Deductions On Schedule A Will Look Like After Tax Reform, Many freelancers and small business owners believe that, in order for a lunch to count as a business meal, it needs to come with a white tablecloth and a. Standard deduction of $5 per square foot of home used for business (maximum 300 square feet).

IRS Business Use of Your Home (Deductions) Deduction, Irs,, More than 10,257 epfo officials are registered on igot karmayogi. If you work from home, you may qualify for the home office deduction.

Home office tax deduction still available, just not for COVIDdisplaced, The purpose of this publication is to provide information on figuring and claiming the deduction for business use of your home. The home office deduction decreases your business income, and therefore, your gross income.

Business Use Of Home (Form 8829) Organizer 2016 printable pdf download, More than 10,257 epfo officials are registered on igot karmayogi. Many freelancers and small business owners believe that, in order for a lunch to count as a business meal, it needs to come with a white tablecloth and a.

The Master List Of All Types Of Tax Deductions [infographic] Free, The term “home” includes a house, apartment, condominium, mobile home,. Learn which of your home expenses can be tax deductible, how to claim those deductions, and what you can do.

![The Master List Of All Types Of Tax Deductions [infographic] Free](https://help.taxreliefcenter.org/wp-content/uploads/2018/06/Tax-Relief-Center-Types-of-Tax-Deductions.jpg)